You may have heard that one of the biggest ways you can save money on healthcare is by staying “in-network.” But what does that mean, exactly? How can you tell if a doctor is in your network? Why is it more expensive to see a doctor who is out-of-network?

You have questions, and understandably so. Healthcare is one complex topic. Below, we’ll break it down and answer some of the most common (and confusing) questions about in- and out-of-network healthcare and the cost differences for each.

What is an insurance network?

A network is a set of doctors, specialists, other healthcare providers, and hospitals that your insurance company has contracted to provide healthcare services to patients who carry one of their insurance plans. Insurance networks are also called provider networks.

Each of these providers has agreed to accept a certain amount of money — usually a discounted rate — from your insurance company. The rate can vary depending on the type of appointment and the type of doctor. These doctors and facilities are “in-network providers.”

The term out-of-network refers to any doctor or facility that has not agreed to those discounted rates.

Why does out-of-network care cost more?

When you get a medical bill (if you have health insurance), there are two prices. One price is what your insurance company is responsible for paying. The other price is what you are responsible for paying. Together, these prices make up the total cost of your medical bill.

If you get care from an in-network provider, you and your insurance company both end up paying less. This is because of the discounted rate that your insurance company worked out with your provider.

However, if you see an out-of-network provider, you don’t get that discount. Instead, you’ll be charged the same rate that you would if you don’t have insurance at all. Out-of-network care costs more simply because you aren’t offered the same discounted rate you would get if the provider was in your insurance network.

Does insurance cover any out-of-network costs?

If you choose to see a provider who is out-of-network, your insurance company might still pay a portion of the cost. However, some plans only cover in-network providers. This depends on the type of health plan you have. There are four main types of health insurance plans, each with their own rules about in-network and out-of-network coverage.

Preferred Provider Organizations (PPOs): PPOs allow you to choose between getting care from in-network or out-of-network providers. If you use providers that are in-network, you’ll pay less. Out-of-network providers will cost more but will still be at least partially covered by your insurance. You don’t need a referral to see any kind of doctor when you have a PPO plan.

Point-of-Service (POS) Plans: POS plans allow you to get medical care from both in- and out-of-network providers. You’ll choose a primary care doctor who is in-network. Then, your primary doctor can refer you to other providers, as needed. If you want to see an out-of-network provider, you’ll have to ask your doctor for a referral. You will also probably pay more out-of-pocket.

Health Maintenance Organizations (HMOs): HMOs typically only pay for care from providers who are in their network. If you see an out-of-network provider, you probably won’t be covered at all. You’ll have to pay the full cost of the services you get. The only exception is in the case of an emergency (more on that below).

Exclusive Provider Organizations (EPOs): EPOs also limit coverage to care from providers that are in-network, except in emergency situations.

What happens if you accidentally see an out-of-network provider?

Sometimes you don’t have a choice about whether the provider you see is in- or out-of-network. For example, if you go to the emergency room, you probably aren’t in any position to check that your doctor is in-network before you’re treated. Likewise, if you’re having a medical procedure done and an anesthesiologist or another provider who is out-of-network provides treatment, you may not even know until you get your bill.

In an article published on CBS News, Betsy Imholz, special projects director at Consumer Union said “these unexpected out-of-network bills can be part of any hospital stay, planned or emergency. I’ve seen out-of-network bills from assistant surgeons who check on the patient while they’re still unconscious. The patient never even knew the doctor was there. It could be the anesthesiologist or radiologist. There are so many people that touch you medically when you are in the hospital.” One patient, who is featured in the article, learned this the hard way when she received a $15,000 medical bill.

This is a practice called balance billing. It’s frowned upon, in general, but still happens quite often. If this happens to you, you may not have to pay the full bill. Imholz and other experts interviewed in the CBS News article advise that patients should not pay the bill right away.

Instead, if you get a bill with out-of-network charges, they recommend that you:

- Call your state legislator to find out if there are laws in place in your state to protect you from balance billing.

- Call the provider who sent you the bill and ask them to explain all of the charges. You can then ask for the bill to be reduced to the amount it would have been had all your providers been in-network.

- Call your insurance company and ask that they check your medical bill for coding errors or any other discrepancies that could be making it higher than you expected.

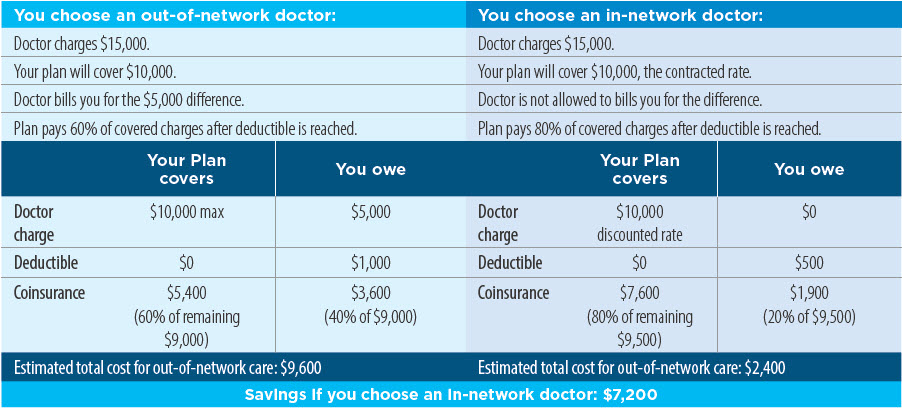

What factors determine how much you pay for out-of-network care?

Many factors play a role in how much out-of-network care costs. These include things like:

- How much your doctor charges

- How much your insurance plan covers

- The difference between what your doctor charges and what your insurance plan covers (balance billing)

- Whether your doctor is allowed to bill you for that difference

- The percentage of costs your health plan pays after you’ve reached your yearly deductible

This is explained more simply using an example. This in-network and out-of-network comparison from Cigna does a good job:

It’s time to stop paying more than you should for medical procedures

There are a lot of nuances when it comes to in-network versus out-of-network costs. Thankfully, there are plenty of ways to navigate the system and ensure you’re getting a fair price for healthcare:

- Contact your insurance company and find out what percentage, if any, they pay for out-of-network care

- Be sure to find out if a provider is in-network before you see them

- Always check to see if a facility is in-network before receiving care

- Look for outpatient facilities when possible, as they tend to be less expensive

- If you get a medical bill with out-of-network charges that you weren’t aware of, you can contact your state legislator, your insurance company, and the provider who sent the bill

- If you have a high deductible health plan or are going to pay for your medical procedure out-of-pocket, you can save 40-80% by using Patient Assist.

In-network, out-of-network. Inpatient, outpatient. The ins and outs of healthcare costs are confusing. New Choice Health advocates for you, letting you compare cost and facilities, save money, and get high-quality care. Use New Choice Health to compare costs now!