When you hear that you need a procedure like a colonoscopy or a spine surgery, one of your first thoughts is probably how will I afford that? The cost of your medical procedure may even determine whether you get it or not.

You’re not alone. Many Americans have trouble affording the medical procedures they need. Patients with health insurance worry about how they’ll afford their deductible, while uninsured patients are concerned about whether they’ll be able to pay for the total cost of your medical procedure out-of-pocket.

While there are many moving parts that affect the cost of healthcare in the United States, one thing is certain—patients who need care should be able to get it, without worrying about how they’ll pay.

Here’s a closer look at how you, as a patient, can reduce the cost of your medical procedure while still getting high-quality care.

Have your medical procedure done at an outpatient facility

A couple decades ago, most medical procedures had to be performed as an inpatient procedure at a hospital. This included at least one overnight stay and a subsequently higher medical bill.

Now, more patients are turning to outpatient facilities—such as physicians offices and ambulatory surgery centers—as an affordable alternative. In fact, Kaiser Health News found that over two-thirds of operations performed in the United States occur in ambulatory surgery centers. Without the high cost of running a hospital to factor into your medical bill, outpatient facilities can provide the same healthcare services at a much lower cost.

While some questions have been made about whether outpatient facilities are as safe as hospitals, the reality is that they are safe for most people and most procedures. Budget-friendly and just as safe as hospitals? It might sound too good to be true but it’s not. You can save thousands of dollars just by having your procedure done at a standalone facility.

Read our guide on how to find a safe, affordable outpatient center for your medical procedure.

Know your benefits and stay in-network

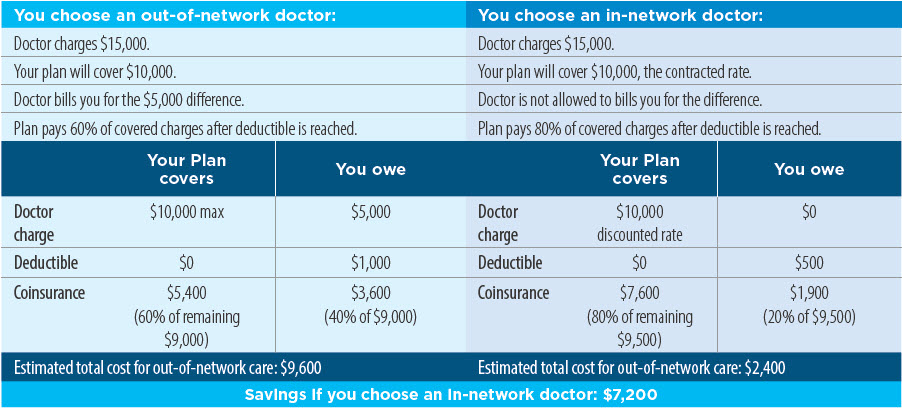

If you have health insurance, you can save a lot of money by knowing what your insurance will pay for—and what they won’t. One of the most important benefits to be aware of is what your insurance covers for both in-network and out-of-network care.

In-network care refers to seeing a healthcare provider or going to a healthcare facility that has negotiated a rate with your insurance company. This rate is often a steep discount from what a patient without insurance would pay.

On the other hand, going to an out-of-network provider or facility usually means you’ll end up paying a higher cost for your medical procedure. This is because the provider or facility has not negotiated a discounted rate.

Knowing the benefits provided by your health plan is key. Some plans only cover in-network providers. Others will pay a set percentage of your out-of-network costs; this usually varies based on the type of service you receive. Since every health plan is different, the only way to know for sure is to contact your insurance company and ask.

By staying in-network when possible, you can save a lot of money on medical procedures. To learn more about this, check out our post: In-network vs. out-of-network care: what is the difference in price?

Travel to a different state for your procedure

Depending on where you live, the cost of your medical procedure might be astronomically high. This often happens in rural areas where there is a shortage of hospitals and providers, which causes the cost of healthcare to rise.

While traveling for healthcare isn’t for everyone, it is a great option that could lead to significant savings. How much you save will depend on the cost of your medical procedure and the cost of travel but, for many patients, the cost difference is well worth it. You may even be able to slip a vacation into your trip, too. Two birds, one stone.

Shop around for a fair price

If you were shopping for, say, a new TV, you probably wouldn’t go with the first one you came across. Like most people, you would probably look online to find out if you could get the exact TV you wanted at a better price.

The same should be true for your healthcare. If your doctor tells you that an ankle replacement surgery is in your future, the first thing you should do is find out what a fair price for that procedure is.

Websites like New Choice Health have developed systems that help consumers find and compare pricing information for different types of medical procedures, without having to jump through hoops. We compare the cost of your medical procedure across different facilities, so you can get an accurate picture of what you can expect to pay — and choose where you get care accordingly.

Read more on how to find a fair price for your medical procedure.

Ask your doctor for a discount on the cost of your medical procedure

Even if your doctor is quoting you the fair price for your medical procedure, like we talked about above, you can ask for a discount. Though they aren’t required to offer a discount to patients who are paying out-of-pocket, your doctor may be willing to work with you.

You might try saying, “I’d love to see you for this medical procedure but I can’t afford your price. Can you offer me a discount since I’m paying out-of-pocket?”

It never hurts to ask. Worst case, they can’t give you a discount. Best case, you get your medical procedure at a price that’s a bit more budget-friendly. Asking for a discount before you have your procedure done is your best bet.

If you don’t have the time or are unsure how to start this conversation with your doctor, look into New Choice Health’s program, Patient Assist.

Ask for generic prescriptions

Prescriptions can be expensive and many doctors prescribe the brand name of the drug without thinking much about it. If you’re insured, you may only have a small prescription co-pay. If you don’t have health insurance and need medication, you could be faced with the choice between paying hundreds to thousands of dollars per month…or going without your prescription.

One way to save money on prescriptions is to ask your doctor to prescribe you the generic version of the same medicine. Generic drugs are a safe and effective alternative; they’re FDA-approved and contain the same active ingredients as their brand-name counterparts. They also tend to cost far less.

Negotiate your medical bill

While it’s ideal to reduce the cost of your procedure before you get the bill, this doesn’t always happen. That’s where negotiating comes in. This can seem like a scary process but doctors, facilities, and insurance companies are used to having patients negotiate their medical bills. There is almost always room for negotiation, too. It can take time and patience to negotiate but you could save thousands of dollars on your healthcare in the long run.

Since most providers and facilities would rather get partial payment than no payment at all, you can start the negotiation process with them. Below are some negotiating tips you can use with your doctor or their billing department:

- If you didn’t ask for a discount before the procedure — You may still be able to get one. Ask this: I want to pay my medical bill but can’t afford the full amount. Are you able to offer me a discount?

- If you can’t afford to pay your whole medical bill upfront — Your doctor or the facility you went to may be able to offer you financing. You can ask this: Do you offer interest-free payment plans for patients who are paying out-of-pocket? Just make sure that any payment plan you get is interest-free, otherwise, you’ll end up paying more over time.

- If you think you’ve been billed incorrectly — Mistakes happen. But when it comes to your medical bill, they shouldn’t be allowed to slide. It can be difficult to spot a billing error but one way to do this is to ask: Can you explain what each code on my bill is for? As your doctor’s billing department explains, take note of anything that doesn’t seem right. For example, did they put two of the same code? This could be a duplicate billing. A code for an x-ray when you didn’t get one is also a red flag. If you see anything that could possibly be out of the ordinary, ask for them to fix it.

If you have a health plan, you can also talk to your insurance company. While they won’t give you a discount, they may be able to help you spot—and correct—discrepancies in your bill.

Use Patient Assist to cut down the cost of your medical procedure

Sometimes discounts and negotiations just aren’t enough. If you’re uninsured and having trouble paying for your medical procedure, you may be eligible for New Choice Health’s program, Patient Assist. Patients who qualify are offered access to a private network of high-quality healthcare providers at a discounted, all-inclusive rate. If you still need help, you can apply for interest-free financing through our partner CareCredit. Learn more about Patient Assist!